Table of Contents

Tax calculation and filing often become more complex when your income extends beyond a regular paycheck, especially if you’re part of a partnership, an S corporation, or a trust. That’s where Schedule K-1 comes in. Many taxpayers find this document confusing because it doesn’t just report income; it outlines their share of profits, losses, deductions, and credits from a business entity or fiduciary arrangement. Misunderstanding the K-1 tax form can lead to inaccurate filings or missed deductions, both of which can attract unwanted IRS scrutiny. Understanding what a Schedule K-1 is and how it works helps you proactively take control of your tax obligations. This article breaks down the form, explains its types, filing requirements, and how it fits into your overall tax return so you can handle it with clarity and confidence.

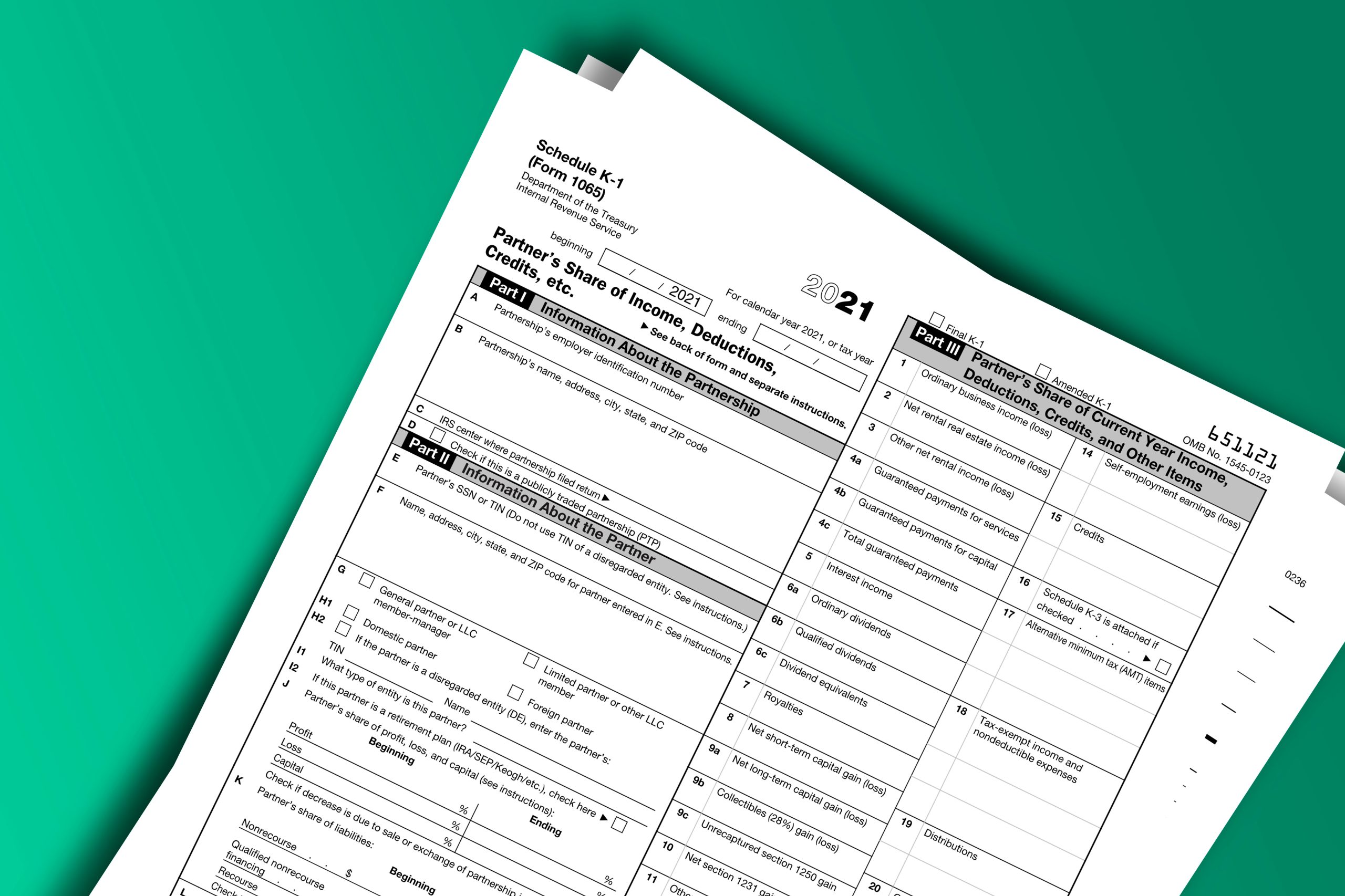

What is Schedule K-1?

Schedule K-1 is an IRS tax document that reports an individual’s share of income, deductions, credits, and other financial information from a pass-through entity such as a partnership, S corporation, or trust and estate. Unlike a traditional W-2 or 1099, which shows income earned directly by an individual, the K-1 tax form outlines the allocation of an entity’s profits and losses among its owners or beneficiaries. Because these entities themselves generally do not pay federal income tax, the Schedule K-1 allows each participant to report their respective share on a personal return, ensuring that all taxable activity is properly attributed. By standardizing how complex financial data is distributed, it promotes transparency, accuracy, and compliance across the federal tax system.

Types of Schedule K-1 Forms

The Internal Revenue Service (IRS) issues different versions of Schedule K-1 based on the type of entity reporting income. Each form serves the same core purpose of distributing an entity’s income, deductions, and credits to its owners or beneficiaries, but the structure and reporting details vary depending on how the business or trust is classified under U.S. tax law.

Schedule K-1 for Partnerships

Schedule K-1 is prepared by partnerships to report each partner’s share of the entity’s income, losses, deductions, and credits. Partnerships do not pay federal income tax at the business level. Instead, they file Form 1065 to disclose the partnership’s overall financial results, and each partner receives a Schedule K-1 for partnerships that specifies their individual share. This information is then used by partners to complete their own tax returns. The form also records guaranteed payments to partners, capital gains or losses, and other distributive items, ensuring that every partner’s tax responsibility is calculated accurately under the pass-through taxation system.

Schedule K-1 for S Corporations

Schedule K-1 (Form 1120-S) is used by S corporations to report each shareholder’s share of the company’s income, deductions, credits, and other tax attributes. Because S corporations generally do not pay federal income tax at the corporate level, these amounts pass through to shareholders, who must include them on their individual tax returns. The form also shows adjustments that affect a shareholder’s stock and debt basis in the company, which determine how much loss can be claimed and whether distributions are taxable. Proper completion of the Schedule K-1 (Form 1120-S) is essential for maintaining consistency between the corporation’s and the shareholders’ reported figures.

Schedule K-1 for Trusts and Estates

Schedule K-1 is filed by fiduciaries of trusts and estates to report income that is distributed to beneficiaries. While the trust or estate uses Form 1041 to report its total income, only the portion allocated to beneficiaries is passed through on Schedule K-1 (Form 1041) for inclusion on their personal tax returns. This approach ensures that income is taxed either at the fiduciary or beneficiary level, but not both. The form details each beneficiary’s share of interest, dividends, capital gains, and other distributed income, as well as any credits or deductions assigned to them.

Don’t Let IRS Tax Problems Keep You Up at Night

Speak with an experienced tax attorney and take the first step toward peace of mind.

Who Receives and Files a Schedule K-1?

A Schedule K-1 is issued to individuals or entities that have an ownership or beneficiary interest in a pass-through entity. This includes partners in a partnership, shareholders in an S corporation, and beneficiaries of a trust or estate. Each recipient uses the information reported on the form to declare their share of the entity’s income, deductions, credits, and other tax-related items on their personal or corporate return. The form ensures that income is taxed to those who actually earn or benefit from it, maintaining transparency within the pass-through tax structure.

The responsibility for preparing and filing Schedule K-1 rests with the pass-through entity itself. Partnerships file Form 1065, S corporations use Form 1120-S, and trusts or estates submit Form 1041, each attaching the relevant K-1 for every partner, shareholder, or beneficiary. While these entities file their overall returns with the IRS, they must also distribute the Schedule K-1 forms to recipients for inclusion in their own filings. Recipients do not send the K-1 separately to the IRS but use the data it provides to complete their tax returns accurately and in compliance with federal reporting requirements.

Key Components of Schedule K-1

A Schedule K-1 provides detailed insight into each partner’s, shareholder’s, or beneficiary’s share of income, deductions, credits, and other financial items from a pass-through entity. These details help ensure that each recipient accurately reports their portion on their individual income tax return. The form’s structure reflects how the Internal Revenue Service (IRS) tracks and attributes taxable income from entities that do not pay corporate income tax directly.

The components of Schedule K-1 vary slightly among partnerships, S corporations, and trusts, but they all share a core framework. Each K-1 includes identifying information, such as the entity’s name and taxpayer identification number, followed by a breakdown of the recipient’s ownership interest and share of items that affect their taxable income. Understanding how these elements work together is essential for accurate filing and avoiding mismatches between entity and individual returns.

Basis and Income Allocation

On a Schedule K-1, the term “basis” refers to an owner’s or beneficiary’s adjusted investment in the entity, which changes each year based on their share of income, losses, contributions, and distributions. This figure determines whether losses can be deducted and if distributions are taxable or tax-free. The income allocation portion specifies how profits, losses, and other items are divided among the partners, shareholders, or beneficiaries according to the entity’s governing documents. For tax purposes, the IRS requires these allocations to have substantial economic effect, meaning they must reflect the actual economic arrangement among the parties and not simply a paper distribution created to reduce taxes.

Deductions, Credits, and Losses

The Schedule K-1 also reports deductible expenses, tax credits, and losses that pass through from the entity to each recipient’s personal tax return. These may include business deductions, capital losses, charitable contributions, or specific credits such as those for foreign taxes or energy investments. Because pass-through entities do not pay federal income tax directly, these items retain their character when reported by the individual, so a business deduction on the entity’s return remains a business deduction on the recipient’s return. Properly tracking and applying these figures ensures accurate reporting and prevents discrepancies between the entity’s filings and those of its partners, shareholders, or beneficiaries.

How to Use Schedule K-1 for Tax Filing

A Schedule K-1 serves as a bridge between a pass-through entity’s financial reporting and the taxpayer’s individual return. The information on this form must be transferred carefully to ensure accurate income reporting and IRS compliance. Here’s how it fits into the filing process:

- Review the entity’s and recipient’s identifying details for accuracy before filing.

- Use the K-1 to determine your share of income, deductions, credits, and other tax items from the partnership, S corporation, or trust.

- Enter each category of income in the appropriate section of Form 1040—ordinary income, dividends, capital gains, or interest.

- Retain Schedule K-1 for your records, as it supports reported figures if the IRS requests documentation.

Reporting K-1 Income on Form 1040

The IRS uses information from Schedule K-1 to verify that income and deductions from pass-through entities are correctly reported on personal tax returns. Key reporting steps include:

- Ordinary business income for a partner or S Corporation shareholder is generally entered on Schedule E (Supplemental Income and Loss).

- Capital gains or losses are reported on Schedule D, while dividends or interest income appear on Schedule B.

- Deductions and credits listed on the K-1, such as charitable contributions or foreign tax credits, must be applied according to IRS rules.

- Limitations may apply based on basis, at-risk rules, or passive activity restrictions. These affect how much loss or deduction can be claimed.

- Use the box numbers on the K-1 as a reference for where each item should be entered on Form 1040.

IRS Compliance and Filing Deadlines

Entities must issue and file Schedule K-1 forms in accordance with IRS deadlines, and taxpayers should ensure timely receipt and accurate reporting to stay compliant. The filing timeline and responsibilities differ depending on the type of entity:

- Partnerships and S corporations: Schedule K-1s are generally due by the 15th day of the third month after the end of the entity’s tax year, which is typically March 15 for calendar-year filers.

- Trusts and estates: Must issue K-1s by April 15 for calendar-year filers, or by the 15th day of the fourth month following the close of the fiscal year.

- Recipients: Should include all K-1 information on their personal tax returns and retain a copy for records. The K-1 itself is not filed separately but serves as supporting documentation.

- If an entity’s filing deadline falls on a weekend or federal holiday, the due date is extended to the next business day.

- Failure to issue or report Schedule K-1 accurately and on time can result in IRS penalties or interest for both the issuing entity and the taxpayer, possibly requiring an amended return to correct discrepancies.

Every Day Counts: Don’t Let IRS Tax Problems Grow Out of Control

Get strategic guidance to resolve your IRS tax issues efficiently.

Is Schedule K-1 Income Considered Earned Income?

Schedule K-1 income is not automatically classified as earned income. Whether it counts as earned or passive depends on the type of entity and the recipient’s role in the business. The IRS differentiates between partnership and S corporation income for this purpose:

- Partnerships (Form 1065): Income reported through a K-1 can be considered earned if it arises from active participation. Guaranteed payments to partners for services are treated as self-employment income and are subject to self-employment tax.

Limited or passive partners typically receive unearned or passive income, which isn’t subject to self-employment tax.

- S corporations (Form 1120-S): A shareholder’s share of income reported on the K-1 isn’t classified as self-employment or earned income. Instead, it’s treated as investment or distributive income, while any salary the shareholder receives is separately reported as wages.

- Trusts and estates (Form 1041): Beneficiaries report K-1 income as distributive or investment income, not earned income, since they generally don’t perform services for the entity.

How Schedule K-1 Affects Your Personal Taxes

Schedule K-1 has a direct influence on how your overall tax liability is calculated. Because income, deductions, and credits from a pass-through entity appear on your individual return, they can affect your total taxable income and eligibility for certain tax benefits. The IRS matches K-1 data with your Form 1040 to confirm that all pass-through items are reported consistently and accurately. Here’s how Schedule K-1 can affect your personal taxes:

- Adjusts your total taxable income: All income categories listed on the K-1, such as ordinary business income, capital gains, interest, or dividends, must be entered on the appropriate schedules of Form 1040.

- May change your tax bracket: Because K-1 income adds to your overall taxable amount, it can move you into a higher bracket or affect deductions and credits that are income-based.

- Triggers self-employment tax in some cases: Active partners must pay self-employment tax on their distributive share and guaranteed payments, while passive investors or S corporation shareholders generally do not.

- Applies basis and passive loss limits: Losses and deductions from the K-1 can only be claimed if you have sufficient basis and meet the at-risk and passive activity rules under IRS regulations.

- Creates potential state tax obligations: Income from pass-through entities that operate in multiple states may require filing nonresident or composite returns, depending on state tax law.

Get Expert Help With Schedule K-1 IRS Tax Issues at the Law Offices of Nemeth & Flores

Dealing with Schedule K-1 reporting or unexpected IRS complications can be overwhelming without professional guidance. Law Offices of Nemeth & Flores provides trusted legal assistance to individuals and businesses facing complex tax situations arising out of tax filing. With years of experience handling partnership income, S corporation filings, and IRS disputes, our IRS tax attorney in Dallas offers practical, results-driven solutions tailored to your needs.

Whether you are clarifying your Schedule K-1 income, responding to an IRS notice, or preparing documentation for review, our team in Dallas, Fort Worth, and Frisco ensures every step is handled with accuracy and care. Contact us today at (972) 426-2944 or submit your details through our contact form to schedule a confidential consultation and take control of your tax concerns with confidence.

Frequently Asked Questions

What is IRS Schedule K-1?

Schedule K-1 is a federal tax form used to report an individual’s share of income, deductions, and credits from a partnership, S corporation, trust, or estate. Each partner, shareholder, or beneficiary receives a K-1 to include this information in their personal tax return.

Who typically receives a K-1 form?

Partners in a partnership, shareholders in an S corporation, and beneficiaries of trusts or estates typically receive a Schedule K-1 to report their share of income or losses.

How does Schedule K-1 affect my personal tax filing?

The information on your K-1 must be reported on your personal tax return. It impacts your total taxable income and may affect your eligibility for certain deductions or credits.

Do I need to file self-employment taxes with my K-1 form?

If your K-1 reports income from an active partnership, you may need to pay self-employment tax. However, income from an S corporation or passive investment may not be subject to self-employment tax.

When is Schedule K-1 due?

For partnerships and S corporations, K-1 forms are typically due by March 15 (the 15th day of the third month after the tax year ends). For trusts and estates, K-1s are due by April 15.

How do I report income from a Schedule K-1 on my tax return?

You must transfer the details from your K-1 to the corresponding sections of your Form 1040, such as income, credits, or deductions. The exact reporting depends on the type of entity that issued the K-1.

What happens if I don’t receive my Schedule K-1 on time?

If your K-1 is delayed, you can file for an extension using Form 4868. It’s important to contact the issuing entity to avoid errors or missed reporting.

Do I have to file Schedule K-1 if I had no income from the partnership or trust?

Yes, even if there is no income or loss, you may still receive and need to file a K-1 to report your ownership interest and confirm that no income was earned for the year.

Is Schedule K-1 income subject to self-employment tax?

It depends on the source of the income. Active participation in a partnership usually makes it subject to self-employment tax, while passive or investment income does not.

What’s the difference between Schedule K and Schedule K-1?

Schedule K summarizes the total income, deductions, and credits of a partnership or S corporation. Schedule K-1, on the other hand, breaks down each partner’s or shareholder’s individual share of those items.

Can I receive multiple Schedule K-1 forms in one tax year?

Yes. If you have ownership in more than one partnership, S corporation, or trust, you will receive a separate K-1 from each entity.

How can a K-1 tax attorney help with IRS issues?

A K-1 tax attorney can help you interpret complex partnership or trust income, ensure proper reporting, and represent you in case of discrepancies or IRS audits.

Can a tax attorney in Dallas–Fort Worth help me deal with issues arising out of Schedule K-1 correctly?

For reliable guidance, reach out to the Law Offices of Nemeth & Flores. Our experienced IRS tax audit attorneys assist Dallas–Fort Worth residents with Schedule K-1 filings, IRS audits, documentation reviews, and responses to IRS inquiries, helping clients manage potential penalties efficiently and confidently.