Identifying who qualifies as a dependent is an important part of preparing an accurate tax return, and the IRS has specific rules that determine when someone can be claimed....

Many taxpayers plan around their refund, so when the payment does not arrive as expected, it naturally raises concern. A late deposit or a status that has not changed...

Most people decide where to live based on work, family, or lifestyle, but state taxes play a major role in long-term financial planning. Income tax can influence take-home pay,...

People are often asked for tax documents by a client, bank, or company, and worry they might be agreeing to something complicated. The request can feel sudden, especially when...

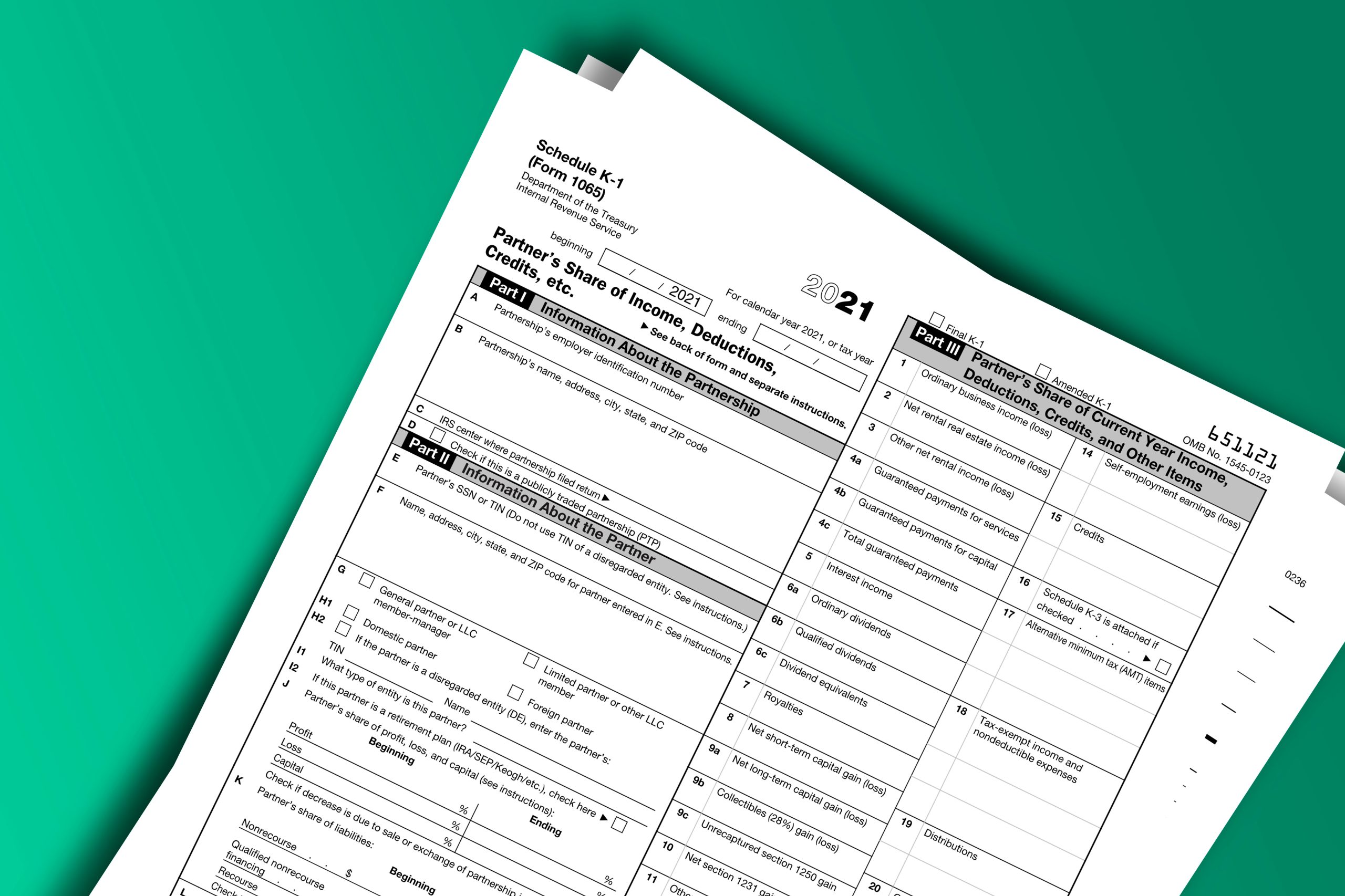

Tax calculation and filing often become more complex when your income extends beyond a regular paycheck, especially if you’re part of a partnership, an S corporation, or a trust....

Many people feel uncertain about how their income is measured on a tax return, especially when distinguishing between adjusted gross income (AGI) and taxable income. One determines your eligibility...

FICA tax is part of every payroll cycle, but many people are unsure how these withholdings are calculated or why the amounts change from year to year. The funds...

Businesses rely on independent contractors for specialized services, seasonal work, or project-based support. After payments are issued, the IRS requires accurate reporting, and Form 1099-NEC is the record used...

Tax paperwork can often blur into a maze of forms and codes, especially when government payments like unemployment benefits or state tax refunds come into play. Among these documents,...

Filing taxes can feel like navigating a complex system of unfamiliar codes, pressing deadlines, and potential missteps at every turn. Central to this process is the 1040 tax form,...