Retirement distributions are reported to the IRS using Form 1099‑R, which covers payments from pensions, annuities, profit‑sharing plans, IRAs, and insurance contracts. Many taxpayers are unsure how the form...

Tax rules change often, and keeping up with credits and eligibility requirements can feel challenging. The Earned Income Tax Credit is one of the most valuable benefits available to...

Tax filings often feel complete the moment they are submitted, but new information or overlooked details can shift the accuracy of a return. Whether it is a corrected W-2,...

Identifying who qualifies as a dependent is an important part of preparing an accurate tax return, and the IRS has specific rules that determine when someone can be claimed....

Many taxpayers plan around their refund, so when the payment does not arrive as expected, it naturally raises concern. A late deposit or a status that has not changed...

Most people decide where to live based on work, family, or lifestyle, but state taxes play a major role in long-term financial planning. Income tax can influence take-home pay,...

People are often asked for tax documents by a client, bank, or company, and worry they might be agreeing to something complicated. The request can feel sudden, especially when...

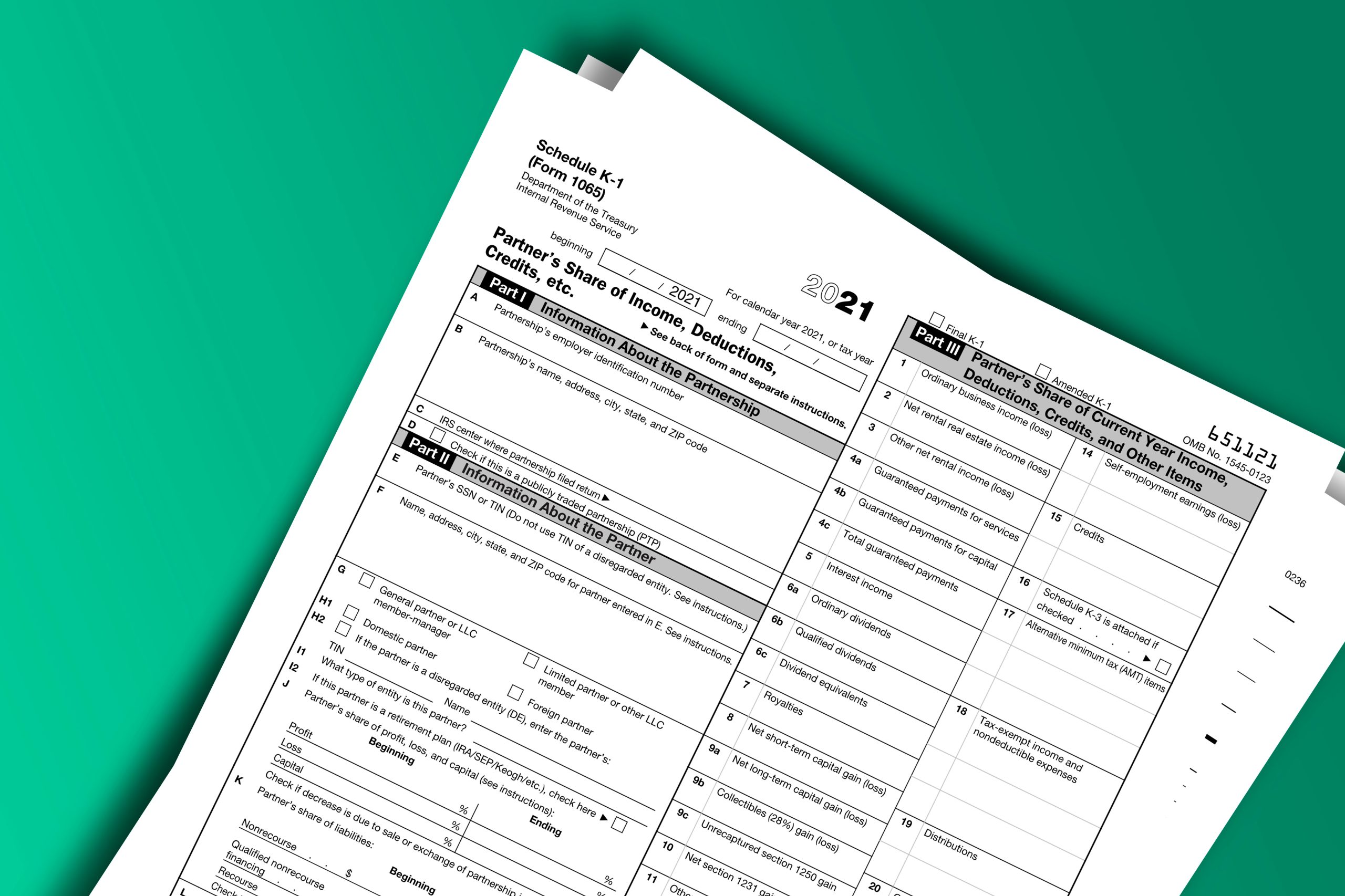

Tax calculation and filing often become more complex when your income extends beyond a regular paycheck, especially if you’re part of a partnership, an S corporation, or a trust....

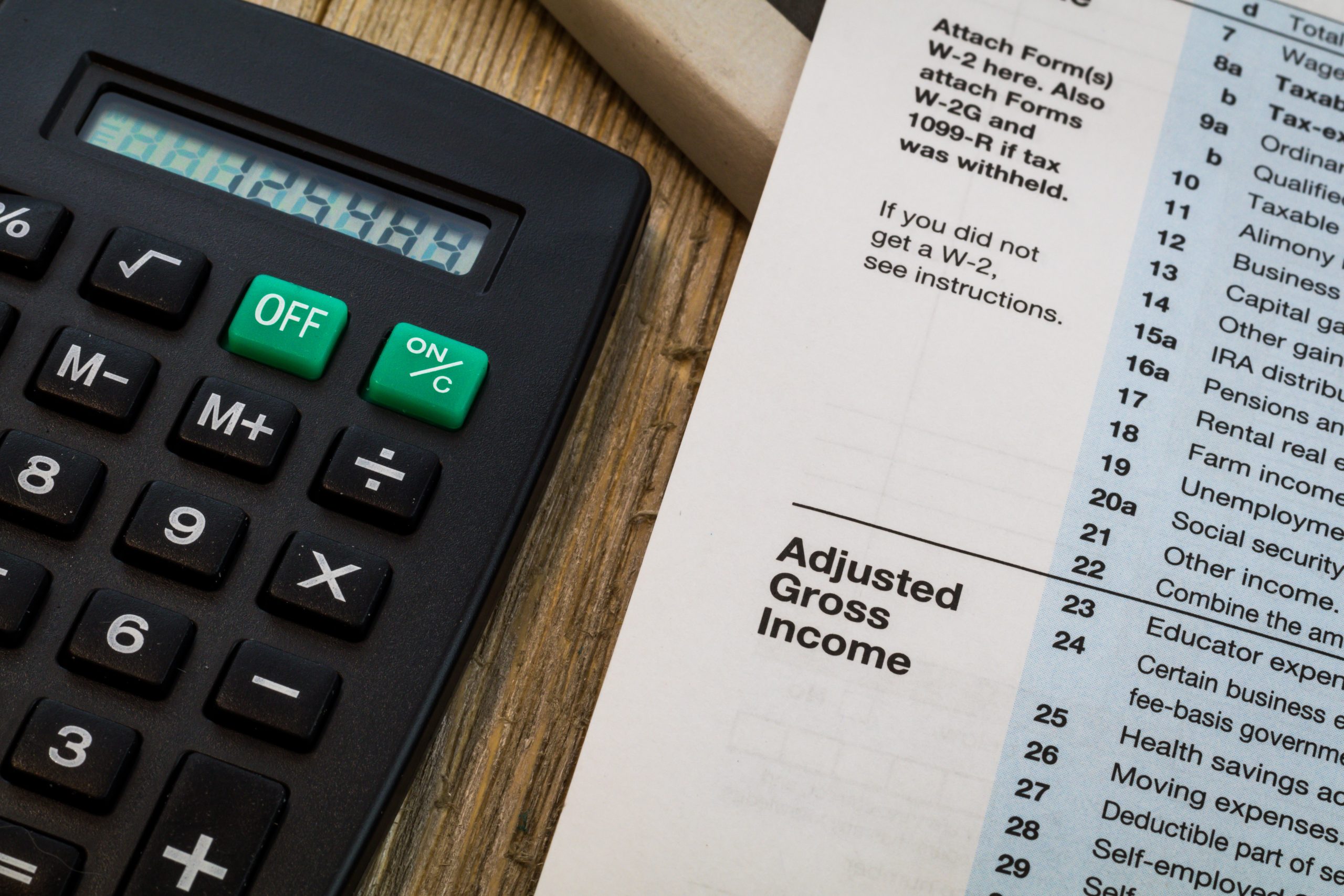

Many people feel uncertain about how their income is measured on a tax return, especially when distinguishing between adjusted gross income (AGI) and taxable income. One determines your eligibility...

FICA tax is part of every payroll cycle, but many people are unsure how these withholdings are calculated or why the amounts change from year to year. The funds...