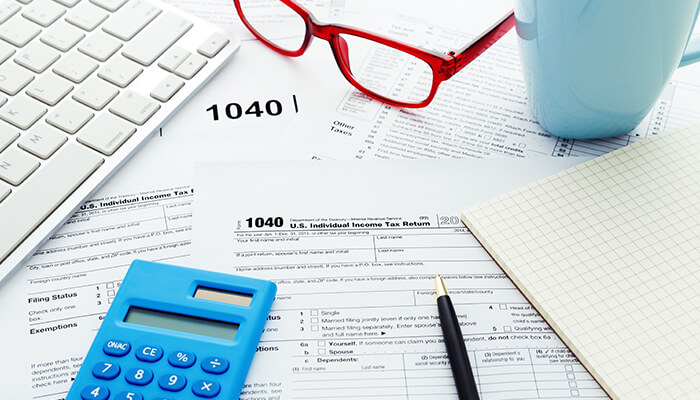

FICA Tax Explained: What It Is, How It Works & Current Rates

FICA tax is part of every payroll cycle, but many people are unsure how these withholdings are calculated or why the amounts change from year to year. The funds support Social Security and Medicare, so accuracy matters for every employer and worker who depends on those benefits. When a business miscalculates payroll taxes, it can…