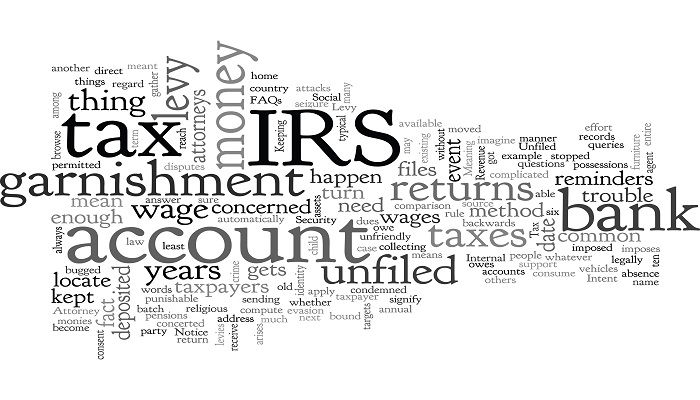

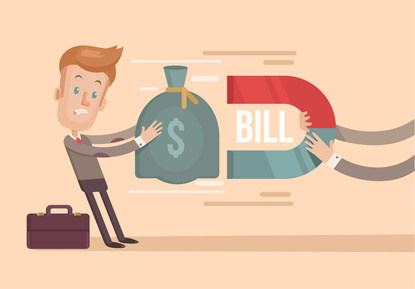

What To Do If a Wage Garnishment is Causing Hardship?

It’s been famously said, ‘You don’t pay taxes — they take taxes.’ The IRS, as a tax collection authority, employs various methods to collect tax debts, one of which is wage garnishment. This process entails withholding a portion of a taxpayer’s paycheck to meet their tax obligations, and it can lead to severe economic hardship,…